Professional women’s football has existed since the 1970s, when Italy became the first country with professional women’s players on a part-time basis. However, women’s sports has been slow to grow compared to men’s sports until recently, when a surge in interest has accelerated progress. Deloitte predicts that football is set to dominate the elite women’s sport market in 2024, with the sport expected to generate over €500 million in global revenue and account for 26% of the elite women’s sports market. While the U.S. initially led this growth, the question we will consider is whether England’s Women’s Super League (WSL) can catch up and capitalise on this momentum.

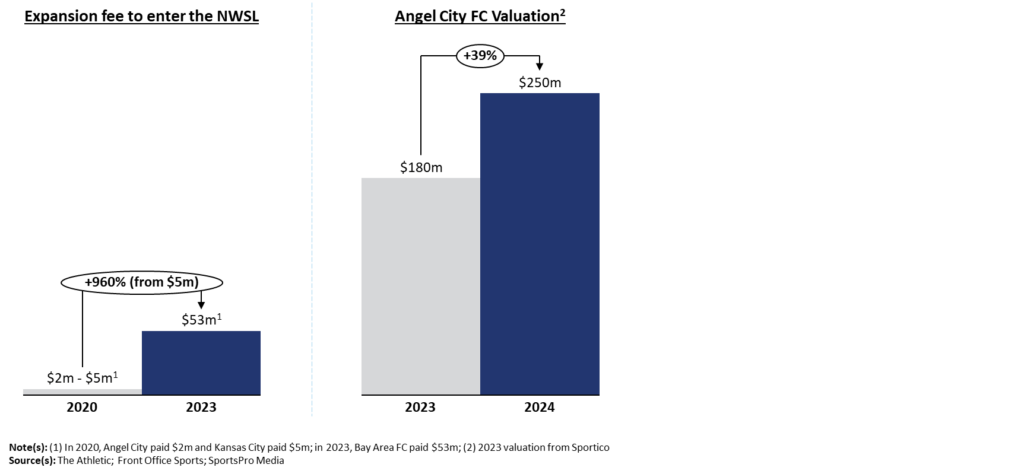

The recent purchase by Willow Bay and Bob Iger of the US National Women’s Soccer League (NWSL) team Angel City FC for $250m is the highest valuation ever for a women’s professional sports team, marking a new era for investment in women’s sport. How has the NWSL grown to deliver this valuation for the team, four years after they entered the league at a $2m fee?

Sponsorship revenue

The total annual value of the NWSL’s current partnership portfolio stands at US$24.5m, which represents a four-fold increase in league-level sponsorship income since 2021.

Broadcast revenue

The NWSL recently announced a four-year deal with ESPN, CBS Sports, Amazon Prime Video and Scripps Sports, totalling $60m a year, which is a 40-fold increase on the annual value of the previous contract ($1.5m a year).

Matchday revenue

The league has seen record attendances each year since Covid-19; Chicago Red Stars vs Bay Area FC in June 2024 broke the NWSL attendance record.

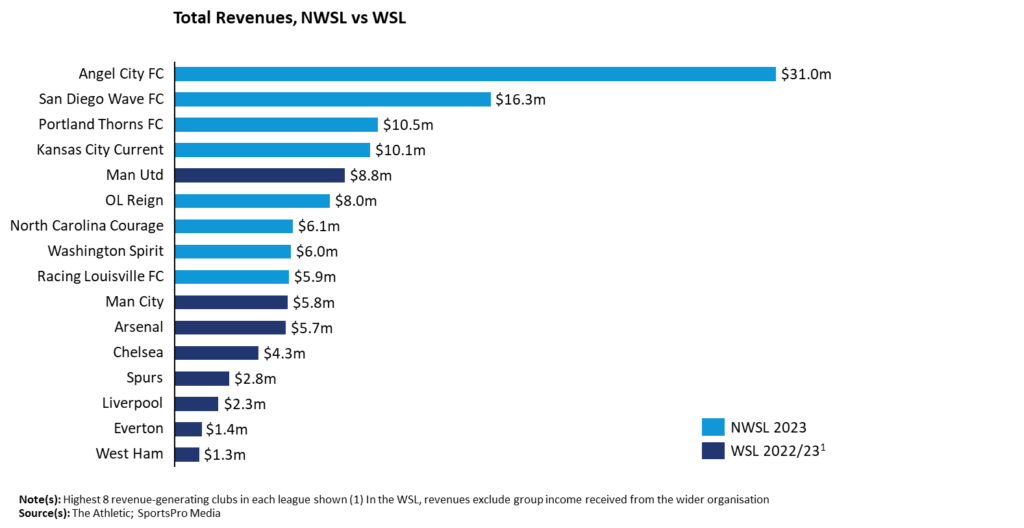

Only Man Utd can claim to have revenues on par with NWSL teams, so what must WSL teams do to compete internationally?

Commercialisation of the WSL and increasing viewership

Sponsors and partners are eager to invest in women’s teams, as these partnerships offer access to a broader demographic and can yield a greater return on investment compared to the men’s game. All 12 WSL clubs had the same front-of-shirt sponsor as their affiliated men’s club in 2022/23, but this “bundling” may not be the best approach for every club; time will tell what approach clubs take. Additionally, clubs are looking to improve attendances. Clubs are increasingly hosting WSL games at their main stadiums, such as Arsenal Women playing the majority of home matches at the Emirates in the 24/25 season.

A new broadcast deal

To really drive revenues though, the WSL must secure a broadcast deal that aligns with the success seen in the WNBA and NWSL, where higher broadcast revenues have fuelled the sport’s expansion. The WSL’s upcoming negotiations for domestic broadcast rights from 2025/26 are crucial. Following a one-year extension with Sky Sports and the BBC, the next contract will be a key indicator of the league’s ability to leverage its rising profile and attract broader investment. Leading negotiations of these contracts will be Women’s Professional League Limited (WPLL), the new governing body responsible for the WSL and Women’s Championship.

WPLL will take over the management of the professional women’s game in England from the FA starting in the 2024-25 season. To ensure the continued success and sustainability of the WSL and Women’s Championship, WPLL will have a lot on its in-tray. As well as commercialising the leagues, the body will need to drive sustainable growth.

Managing the cost base

No WSL clubs were profitable in 2022-23, with the average wages-to-revenue ratio reaching 117% (excluding group income), far higher than the 66% seen at Premier League clubs. Many women’s teams rely on financial support from their associated men’s clubs, with group income accounting for 36% of total WSL revenue. The WPLL will need to introduce regulations to prevent costs from spiralling out of control, ensuring that smaller teams are not forced out due to financial pressures.

Adopting a startup mentality

In many ways, women’s football teams are still startups. For example, business models currently vary greatly between clubs. In 2022/23, excluding group income, Arsenal’s matchday income represented 58% of revenue, whereas commercial income represented 74% of Man Utd’s revenue. Broadcast is yet to dominate revenues like it does in the Premier League. Hence, as women’s football evolves, it’s crucial not to simply replicate the men’s business model. Instead, the WPLL has stated it will embrace a startup mentality. Experimentation that goes beyond traditional broadcast deals will be important. This mindset will be vital in carving out a distinct and sustainable path for the women’s game.

Chelsea have publicly stated they value their women’s team similarly to NWSL team Angel City FC (when Angel City were valued by Sportico at $180m). Is this realistic?

NWSL league structure guarantees revenue

Readers familiar with US league structures will be aware that their format ensures no relegation, and so guarantees revenues year-on-year. This structure drives a naturally higher valuation.

Difficulty valuing WSL teams

In the upcoming 2024/25 season, all 12 WSL clubs will have a Premier League equivalent. The combined structure questions the ability of women’s teams to attract dedicated external investment, as a prospective investor would currently need to invest through a men’s team. Additionally, it is hard to value these clubs as many do not yet provide full financial data on revenue, assets, equity, fanbases and more.

Given all of this, it is difficult to place a value on current WSL teams. Currently a $180m valuation for Chelsea seems steep given revenue streams, but these will grow, and soon we will begin to understand what revenue is possible for WSL teams.

Ready to take your sports start-up to the next level? Let's collaborate and redefine the game together.