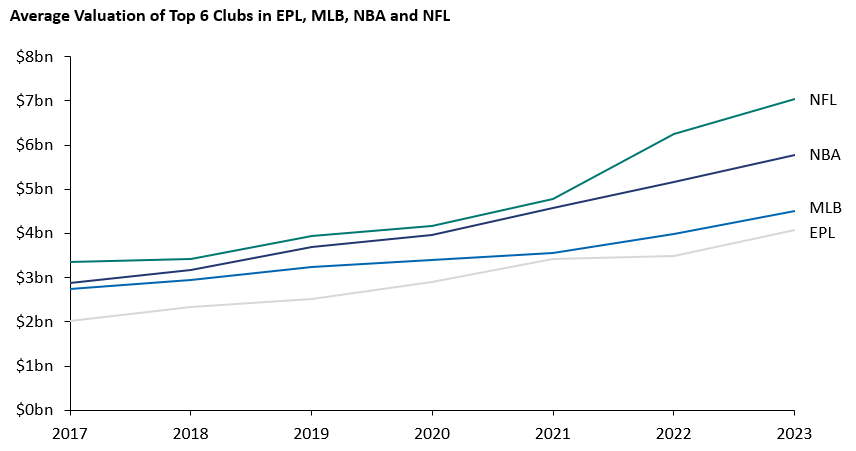

In a groundbreaking moment in late 2024, the Dallas Cowboys became the first sports team valued at over $10 billion. This achievement highlights a broader trend of skyrocketing sports team valuations. In 2017, the top 50 most valuable teams were collectively worth $133 billion; by 2023, that number had nearly doubled to $256 billion. U.S. teams dominate the most valuable list, consistently comprising over 75% of the top 50. But what drives these valuations, and why are they growing so rapidly? Let’s explore the key factors fuelling this phenomenon.

The Global Value of Sports Teams

Source: Forbes

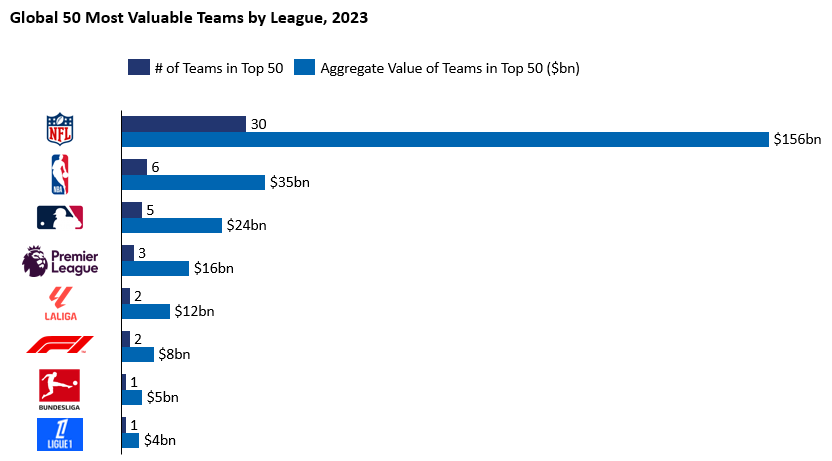

Sports team valuations have surged, with U.S. teams leading the way. This growth is spearheaded by the National Football League (NFL), whose franchises account for 30 of the 50 most valuable teams, as shown below.

Source: Forbes

1. Television Revenue

Television deals are the backbone of U.S. sports team valuations. In 1946, the New York Yankees made history as the first team to secure a local television contract, selling broadcast rights for $75,000. By the late 20th century, the value of these rights had skyrocketed, with the team earning $52 million annually from the same arrangement. The increasing value of media rights has created a consistent upward trajectory for franchise worth.

2. Revenue-Sharing and Salary Caps

In leagues like the NFL and NBA, team owners have effectively used collective bargaining agreements (CBAs) to negotiate with players’ unions. These agreements cover revenue sharing, salary caps, and other key aspects of league operations, allowing owners to present a united front in negotiations. Importantly, these mechanisms shield teams from fluctuations in fan engagement and local market dynamics. For example, revenue-sharing systems ensure teams receive significant income from media rights regardless of market size. Salary caps further enhance profitability by limiting player salaries. For instance, the NBA’s 2011 agreement reduced player wages from 57% of basketball related income to 51.15%.

This structure makes U.S. teams exceptionally profitable. In 2023, every NFL team operated in the black, with a minimum operating income of $56 million. In stark contrast, Premier League teams collectively lost around £1 billion in the 2022/23 season.

3. Economic Reforms and Corporate Welfare

Economic changes in the 1980s, such as reducing the top income tax rate from 70% to 28%, expanded the pool of potential team owners. Additionally, U.S. teams benefit from substantial state subsidies for stadium construction. For instance, the Raiders’ Las Vegas stadium received $750 million in taxpayer funding. Many teams even enjoy low or no rent in publicly funded stadiums.

4. The Prestige of Ownership

Owning a sports team brings unparalleled visibility and prestige. High-net-worth individuals (HNWIs) view team ownership as a status symbol, creating fierce competition for these prized assets. The exclusivity of this “club” further drives valuations.

Expansion has been a cornerstone of U.S. sports leagues. Historically, leagues expanded during periods of economic growth, such as Major League Baseball’s post-war expansions in the 1960s and the NBA’s southeastern growth in the late 1980s. Expansion also often coincided with star power—Michael Jordan’s rise, for example, drove the NBA’s growth in the 1980s and 1990s.

Leagues also strategically entered key markets to maximize visibility and revenue. The NFL re-established a presence in Houston with the Texans in 2002, while the NBA brought a team back to Charlotte in 2004. Geographic diversification has been another strategy; the NHL expanded into the southern U.S. during the 1990s and 2000s to grow hockey’s appeal in untapped regions.

Recent years have seen demand for the introduction of new teams across major leagues. Recent men’s team examples include Austin FC (MLS, 2020), Seattle Kraken (NHL, 2021), Charlotte FC (MLS, 2022), and St. Louis City SC (MLS, 2023). The WNBA and NWSL are the two women’s leagues that are dominating current expansions. They are not alone, with the NBA and MLB suggesting they are keen to capitalise soon on the robust U.S. sports environment and burgeoning fan bases.

The soaring valuations of U.S. sports teams are underpinned by lucrative television deals, robust revenue-sharing systems, favourable economic policies, and the allure of ownership prestige. As U.S. television deals continue to grow and leagues continue to expand, these valuations currently show no signs of slowing. Will we be saying the same in ten years from now? For now, with new opportunities in emerging sports and markets, U.S. teams remain firmly at the pinnacle of the global sports landscape.

Ready to take your sports start-up to the next level? Let's collaborate and redefine the game together.