Last year over 850 million health apps were downloaded with almost 350 million users, tracking everything from exercise to mental health, generating $3.98bn in revenue (11.1% up on 2023). In 2023, venture capitalists poured $5.7bn into sports tech startups.

Societal trends look promising for social fitness apps: participation in sports and health hobbies is becoming something to broadcast via social media, and the barriers to entry, and focus on competitive performance in sports like running are decreasing: average finishing time in running races is becoming slower, suggesting greater participation from recreational runners, a large target market for social health platforms. The focus on sports as a leisure activity to be shared creates a desirable environment for the sports social media apps.

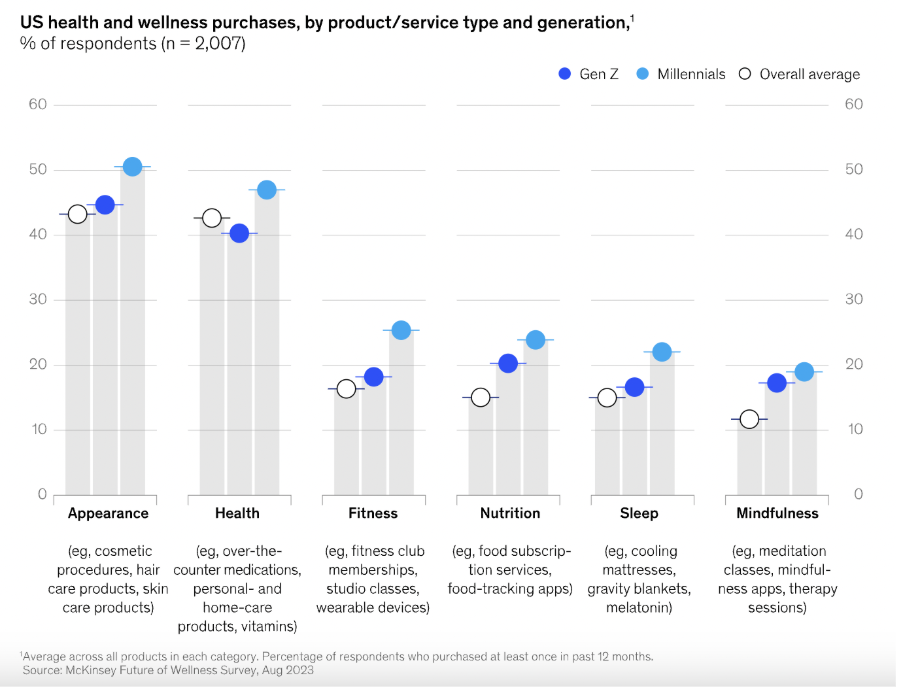

Moreover, younger generations are investing more in their health and fitness – in 2024, 23% of surveyed Millennials in the UK claimed spending on gym memberships and health was their top priority. Similarly, in the US, in 2023, Millennials and Gen Z both spent above the population average on fitness, nutrition, sleep, and mindfulness consumer goods. Notably, Gen Z also spent less than average on health products such as over-the-counter medication, suggesting younger generations take a preventative rather than reactive approach to staying health, for which fitness apps provide the perfect tools.

For many, Strava is the archetypal sports social media platform with 150+ million users in 185+ countries. Its core function is exercise tracking for sports such as running, or cycling. However, much of the success stems from embracing the social and hobby elements of sports, as shown by the user data: of all 150+ million users, only about 0.02% are professional athletes – for most, Strava is a tool to track pastime sporting endeavours. The social aspect is clear too: last year, Strava accounts gave each other more than 12 billion ‘Kudos’, and the app had almost 1 million ‘Clubs’. Strava clearly relies on customers who prioritise sports as a leisure activity.

The app’s features have evolved to resemble mainstream social media more closely. Strava’s ‘Kudos’ and comment functions have long incorporated features ubiquitous in the social media sector. Over time, though, Strava has increased the social aspects of the app, introducing picture and video sharing, much like Instagram, and, in 2023, direct messaging, suggesting the social element is a prominent driver of growth.

The business side of Strava, recently valued at $42.2bn, illuminates the strength of the sports social media market. Most income is from its subscription model, but sponsored challenges, in which the social aspect is key, provide another revenue stream. Strava have recently grown through M&A: 2023 saw their acquisition of FATMAP, a 3D mapping software. In 2025, Strava acquired the running training-plan app Runna, and the cycling coaching app The Breakaway. Strava’s valuation and this recent increase in acquisitions is good news for sports social media startups.

Increasing focus on recreational sports by younger generations, who already use social media frequently, implies significant potential for the sector’s future. It is likely tracking apps for even more sports will develop, and even greater emphasis on the social element is probable. The prevalence of strength training apps, and the large lifting community on social media, could prompt an app similar to Strava for social gym-workout tracking.

Strava’s acquisitions and increasing sports coverage suggest a trend towards being an all-in-one healthy lifestyle social media. Considering the success of nutrition-tracking apps (MyFitnessPal has 200 million users and reached revenues of $310 million in 2023) Strava could look to incorporate nutrition tracking. It already measures calories burned, and nutrition would be a natural progression.

Potentially, a big player in the mainstream social media sector such as Meta could try to acquire Strava-style social fitness apps to target ads at a specific health-conscious demographic more easily. A software or sports wearable company could also try to acquire a fitness social media platform and incorporate a social element into their tracking. An example might be Apple, who already record fitness data but somewhat lack the social side.

Overall, the trend in leisure sports towards a social media style appears still to be growing, and to have a promising future.

Ready to take your sports start-up to the next level? Let's collaborate and redefine the game together.