The maiden SailGP Championship was held in 2019. Fast forward 5 years, it generates up to $150 million. What was the brainchild of Oracle co-founder Larry Ellison, and Kiwi Olympic yachtsman Russel Coutts, and set to be a loss-making private competition for only the greatest of sailing aficionados, is now a thirteen-race tournament involving twelve teams, held across five continents. Beyond the realm of competitive water sports, stand-up paddleboarding (SUP) has likewise seen rapid growth as a recreational sport. In the UK alone, 4.5 million people have participated in SUP and more than 1 million own a paddleboard. Could water sports emerge as a rapidly growing market?

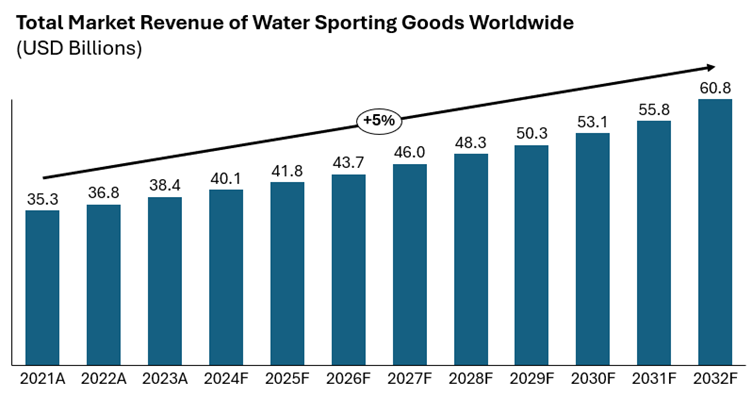

Worldwide, the market for water sporting goods including gear and apparel, had a total revenue of $38.4 billion in 2023 and witnesses a CAGR of 4.9% between 2021 and 2032. Here, water sports include any physical activity on or under waterbodies, ranging from Olympic classics such as swimming to kitefoiling, a debutant sport of Paris 2024. Within this market, the total revenue for gear sits at $15.4 billion as of 2025 and is projected to grow at a CAGR of 5.48%, with the Indian market capturing $2.3 billion, the largest share of this sub-market, driven by rising demand for boards, kayaks, snorkel- and swim-gear.

In the States, the National Marine Manufacturers Association recorded a 7% rise in water sports participation between 2019 and 2024, driven by four key sports: surfing, kayaking, SUP and snorkelling. While SUP saw a 9.3% increase in participation rate, it was surfing that saw the greatest increase at 28.5%, followed by kayaking at 23.1%.

Across the Atlantic, outdoor swimming remains the most popular water sport by far – 17.9% of Britons participate in it at least yearly. In England alone, 4.2 million adults swim at least once a fortnight and more than 25% of children are engaged in swimming and/or diving. The runners-up, kayaking and canoeing recorded participation rates just over 10%, but by online interest, have the highest number of (4,203,400) Google searches between July 2023 and June 2024, more than tenfold the next most searched water sport. Kayaking alone saw a year-on-year 107.56% increase in total searches compared to July 2020 to June 2021, rising by 2 million searches.

On the continent, Germans were found to be some of the most enthusiastic water sports participants. 6 million partook in water sports at least once a year, of which SUP, sailing and motorised water sports have been the fastest growing. In fact, the proportion of Germans who take part in water sports at least once a month has witnessed a 157% growth from 2018 to 2021, driven in part by COVID-19 movement restrictions. Arguably, the longstanding national water sport in Germany could be recreational fishing in which 9.4% of the population engages, with high yearly ARPU of more than $1,000.

Most poignantly, India’s water sports gear market is experiencing an 8.0% CAGR between 2023 and 2028, with a boom in domestic tourism involving hard and soft adventure water sports where an appetite for recreation is driven by the country’s many large metropolitan populations seeking some respite from the urban.

Here then are 7 key areas of opportunity in the world of water sports technology:

1. Innovations in water sports gear: e,g., electric hydrofoil devices, GPS-enabled surfboards, advanced weatherproof materials

2. Apps for finding water sport activities: e.g., The Surfr app lets 80,000 waterboarding sportsmen and sportswomen find new sites and connect

3. Sensors and apps for tracking water sports performance: e.g., WOO Sports offers smartwatch apps and sensors specifically for kiteboarding jump statistics

4. Engineering for inland water experiences: e.g., artificial wave technologies for surfing centres making surfing more accessible inland and for beginners

5. Real-time environmental monitoring: e.g., satellite imagery, machine learning and AI systems are integrated with in-yacht sensors for route optimisation

6. Operation management software for water sport businesses: e.g., Bloowatch offers academies, gear providers, etc. software to manage customer relations

7. Online marketplaces for water sports gear: e.g., Sea and Buy, akin to eBay but for community of divers, sailers, paddleboarders, etc. across Europe and the US

While these are seven pools of swelling opportunity, the key questions remain whether these trends will persist and if so, will they accelerate. For now, converging trends of urban dwellers with large spend propensity seeking unique experiences in natural environments, a rising tide of concern for personal health and mental wellness and the potential for AI and digital technologies in highly technical water sports can be seen as the undercurrents that stir growth in these markets.

However, seasonality and safety concerns, inherent to the raw and unpredictable nature of the seas and streams remain a hindrance to mass uptake of outdoor water sports. In the UK, the Royal National Lifeboats Institution reported a threefold rise in emergency deployments linked to the popularisation of SUP at sea. Equally, concerns over microplastic pollution from gear, the relative inaccessibility of clean waterways and the unaffordability of gear still hinder many water sports from entering the mainstream. Yet, where the strongest headwinds blow, the greatest waves of innovative opportunity take shape. The world of water sports has seen keen innovations. It awaits more to come.

Ready to take your sports start-up to the next level? Let's collaborate and redefine the game together.