The sportswear industry is evolving, with consumer interest in health and wellness playing an increasingly significant role. But to what extent is this shift driving revenue growth for both dominant brands and emerging players? And how should investors assess the opportunities this presents?

There are indications that engagement in activities like running, yoga, and home workouts is increasing. Strava, a leading fitness tracking platform, reported a 9% rise in logged marathons, ultramarathons, and century rides in 2024 compared to the previous year, alongside a 59% increase in global running club participation. In the U.S., the number of yoga participants has grown by nearly nine million since 2014. If these trends continue, will they translate to sustained demand for performance and lifestyle sportswear?

Major players in the industry appear to be benefiting from consumer focus on health and fitness. Nike recently surpassed $50 billion in annual revenue, reinforcing its market leadership, though it has struggled to stretch beyond this figure. Meanwhile, PUMA, ranked third in sales, has expanded its influence through high-profile collaborations, including a partnership with Manchester City Football Club. Lululemon’s trajectory potentially raises the most interesting questions—having started as a niche yoga brand, it now claims the fourth-largest market share in sportswear, dislodging Skechers from fourth spot.

| Brand | Annual Revenue | Market Position |

| Nike | $50B+ | #1 |

| Adidas | $25B+ | #2 |

| PUMA | $9B+ | #3 |

| Lululemon | $8B+ | #4 |

| Skechers | $7.5B+ | #5 |

If these companies are growing despite an increasingly competitive landscape, what strategies are proving most effective? And are these strategies sustainable for long-term dominance?

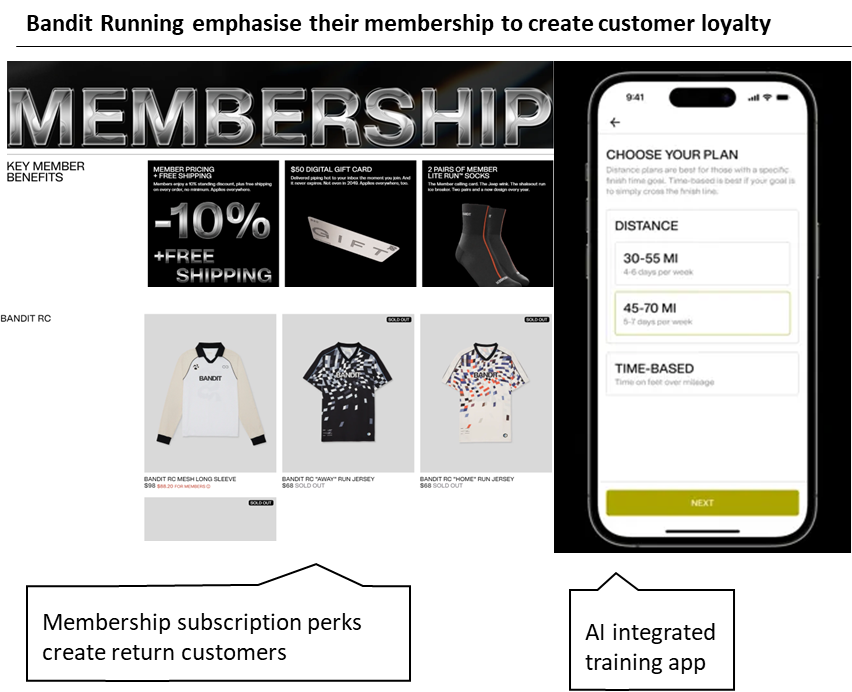

While incumbents hold strong positions, newer players are finding ways to differentiate themselves. Brands like On and HOKA have capitalized on the demand for high-performance running shoes, each reporting double-digit growth—On by over 30% and HOKA by 25%. Meanwhile, startups such as Castore and Bandit Running are using advanced materials and niche branding to carve out space in an increasingly crowded market.

| Brand | Sales Growth (YoY) |

| On | 30%+ |

| HOKA | 25%+ |

With such rapid growth, are these companies posing a real threat to incumbents? They are stealing pockets of market share, but will larger brands continue to dominate through economies of scale and brand recognition?

For investors looking at sportswear, several factors could define future success stories:

Tech-driven innovation: Advances in smart fabrics, sustainable materials, and AI-powered personalization are changing consumer expectations. Which companies will lead in these areas?

Channel strategy: While own channels (online and brick-and-mortar stores) is an attractive model, Nike’s recent missteps in shifting too aggressively away from wholesale raise important questions. What is the right balance?

Expansion of niche markets: Lululemon’s evolution suggests that smaller brands can expand into new categories. Which up-and-coming brands are poised to make a similar leap?

Tariffs: Many leading brands rely heavily on international manufacturing, particularly in Asia, for apparel and footwear production. Tariffs can significantly raise import costs, compress margins, and disrupt supply chains; even modest tariff changes can affect pricing and consumer demand

Consumer trends suggest that health and wellness could continue to drive demand in sportswear, but how this translates into sustained business success remains an open question. While established brands are holding their ground, new entrants are finding room to grow. For investors, the key may be identifying which companies are best positioned to adapt to an evolving market. Will innovation, branding, or business model agility be the differentiating factor in the years ahead?

Ready to take your sports start-up to the next level? Let's collaborate and redefine the game together.