Since the end of the COVID-19 pandemic, societies have had somewhat of a different relationship with brick-and-mortar shops and in person experiences. As waves of digitalisation have swept across many sectors, innovations in the digital world have accelerated. Yet, there remains a desire for meaningful social interactions in the flesh, a good beer, wine or a nice mocktail, and an element of fun in physical interpersonal activities, be it board games, sports or the sort.

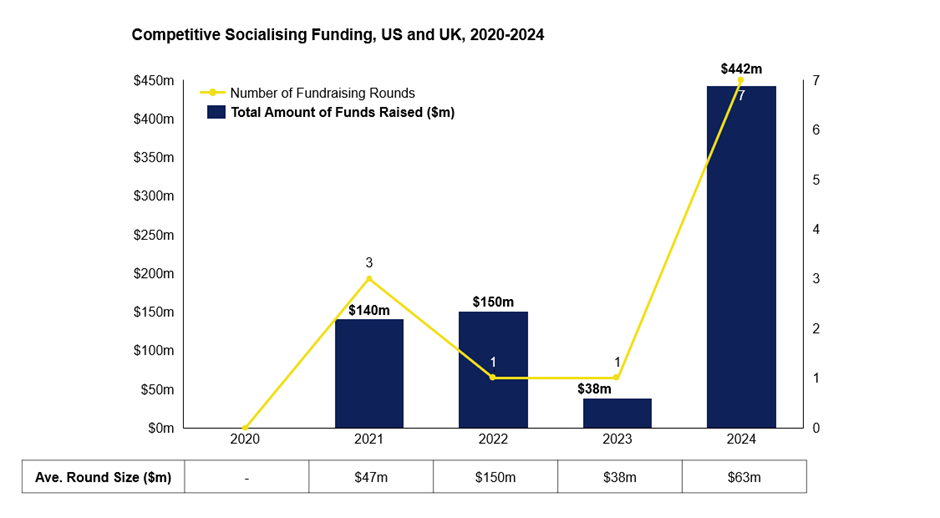

At the crossroads of these trends sits the competitive socialising market, which between 2021 and 2024, exploded with a near fourfold growth. Industry leaders like F1 Arcade and TOCA Social have secured ~$40m and $130m for US and worldwide expansion respectively, while the Jolliffe twins, who had begun the world-leading competitive socialising business TopGolf, have just invested $15m into their latest venture. They are launcing Poolhouse, an interactive, digitalised and AI-enhanced, in-person pool experience integrated with the warmth of a pub and state-of-the-art digital technology that customises the difficulty of the game depending on level of experience. In the US and UK alone, $1.2 billion that has been invested into tech-enabled competitive socialising, and $770 million of which was committed within the last 5 years.

TopGolf venue at Scottsdale, Arizona is one of TopGolf’s 106 worldwide (Source: Discover Salt River)

TOCA Social’s integrated F&B and football-inspired digital games in the UK; they are about to open their first North American venue in Dallas, Texas (Source: Sysco Productions)

The US has seen more than four times the amount of funding the UK has. In terms of concepts and ventures, however, the UK rivals the US, with industry leading companies like TopGolf having begun in Watford, Hertfordshire, and F1 Arcade and TOCA Social entering the US. In the UK, many of the biggest companies are headquartered in London, while half of the of the best-funded US firms are found in Texas, primarily in Dallas.

Millennials and Generation Z have been at the forefront of the competitive socialising boom in the UK. While only 1 of 4 aged 66-years and above indicate interest in competitive socialising, 4 of 5 aged 18 to 35-years-old demonstrate interest. In fact, 2 of 5 Gen Z customers have already visited a competitive socialising venue in Britain, while nearly half have competitive socialising in their upcoming plans. It could be that the pandemic’s acceleration of digital experiences and the simultaneous reminder of our humanity’s need for genuine in-person interaction that has driven the younger generation to desire more than just food and drink but unique and premium experiences in the flesh, fused with technological innovations.

Yet, the most valuable customers are not groups of young co-workers or friends, which each have an ARPU of £986 a year, but families with children which spend an average of £1,410 a year – nearly 150% more. When asked for motivations behind visiting competitive socialising venues, family outings with children were the most cited factor – 53% would choose a competitive socialising venue over the traditional pub. Hence, while Gen Z and Millennials may contribute the bulk of customers, families are equally, core target customers that competitive socialising companies must continue to appeal to or even grow their penetration with.

With the explosion of competitive socialising comes growing competition. As competitive socialising becomes embedded as a mainstream leisure option, regular customers demand more sophisticated and fresh offerings. Additionally, in the UK at least, rising OpEx in the form of the April 2025 increase in minimum wage and employer contribution to employee insurance. Simultaneously, rising living costs, have been cited as one of the key concerns for a potential slowdown in footfall.

Contrary to expectations, however, even when customers sought to cut expenditure, a study has shown that competitive socialising venues can compete with traditional leisure options like restaurants and pubs. In fact, only 22% of Britons would choose to cancel plans to visit experiential venues, versus 32% to restaurants and 39% to pubs or bars. Hence, in times of steep cost increases, competitive socialising should see equal, if not proportionally less loss of visitorship.

To navigate the challenges, a strategic geographical approach in select urban areas is key. After costs (cited by 48%), location (28%) was the most cited barrier to customers. Contrary to previous assumptions that competitive socialising has large catchment areas, Richard Harpham, CEO of XP Factory, which runs Escape Hunt and Boom Battle Bar, notes that despite already having 26 Escape Hunt rooms in the UK, he intends to add up to 10 sites yearly, as he has discovered that venue location density can be increased within the same metropolitan region. At a greater scale, businesses looking to expand, have targeted Liverpool as a hotspot city, beyond the trio of London, Manchester and Birmingham.

XP Factory’s Boom Battle Bar is a multi-sport competitive socialising venue, including beer pong; this image features the Wandsworth venue, one of 30 spread across the UK (Source: Retail & Leisure International)

XP Factory’s Escape Hunt’s Dubai branch featuring highly crafted and themed escape rooms (Klook)

Beyond geography, businesses have also looked to diversify their offering without incurring increases in CapEx, by adapting their digital games every few months, as well as appealing to Gen X as an appealing site for just F&B, without having to play games. Amongst top players, licensing their technology and offering it to traditional pubs and restaurants, or even offering it as home-based entertainment are in the works.

Standing at the crossroads of three tenets of wider Western culture, and as reflected in the UK and US, the appeal of the traditional in-person pub experience, the acceleration of digital technologies in the leisure and the love for friendly competition and sports will continue to drive the success of competitive socialising. For the up-and-coming, there exist many opportunities to ride the rapidly rising tide of competitive socialising’s boom.

Ready to take your sports start-up to the next level? Let's collaborate and redefine the game together.